AI-Powered Economic Analytics

Discover how artificial intelligence is revolutionizing economic analytics. In this article, we'll explore the cutting-edge applications of machine learning algorithms for market prediction, sentiment analysis, and automated trading strategies. We'll also dive into real-world case studies and practical applications that are shaping the future of investment decision-making.

The Rise of AI in Economic Markets

Artificial intelligence has become an indispensable tool for investors and economic institutions alike. By leveraging vast amounts of data and complex algorithms, AI systems can identify patterns and trends that human analysts might miss, leading to more informed investment decisions and improved portfolio performance metrics.

Key Applications of AI in Economics

- Market prediction and trend analysis

- Sentiment analysis of news and social media

- Automated trading strategies

- Risk assessment and management

- Fraud detection and prevention

Machine Learning Algorithms for Market Prediction

Machine learning algorithms have become increasingly sophisticated in their ability to forecast market movements. These algorithms analyze historical data, economic indicators, and even alternative data sources to make predictions about future market trends. Some popular machine learning techniques used in economic forecasting include:

- Neural Networks

- Random Forests

- Support Vector Machines (SVM)

- Gradient Boosting

By utilizing these advanced algorithms, investors can gain valuable insights into potential market movements and adjust their strategies accordingly.

Sentiment Analysis: Harnessing the Power of Public Opinion

Sentiment analysis is another powerful application of AI in economic analytics. By analyzing news articles, social media posts, and other textual data sources, AI systems can gauge public sentiment towards specific companies, sectors, or the overall market. This information can be crucial for predicting short-term price movements and identifying potential investment opportunities.

Benefits of Sentiment Analysis

- Early detection of market-moving events

- Improved understanding of investor psychology

- Identification of emerging trends

- Enhanced risk management

Automated Trading Strategies: The Future of Investing

AI-powered automated trading strategies are revolutionizing the way investors approach the market. These systems can analyze vast amounts of data in real-time, identify trading opportunities, and execute trades with minimal human intervention. Some key advantages of automated trading strategies include:

- Faster execution of trades

- Elimination of emotional decision-making

- Ability to backtest strategies using historical data

- Continuous monitoring of multiple markets

While automated trading systems offer significant advantages, it's important to note that they still require careful oversight and risk management to ensure optimal performance.

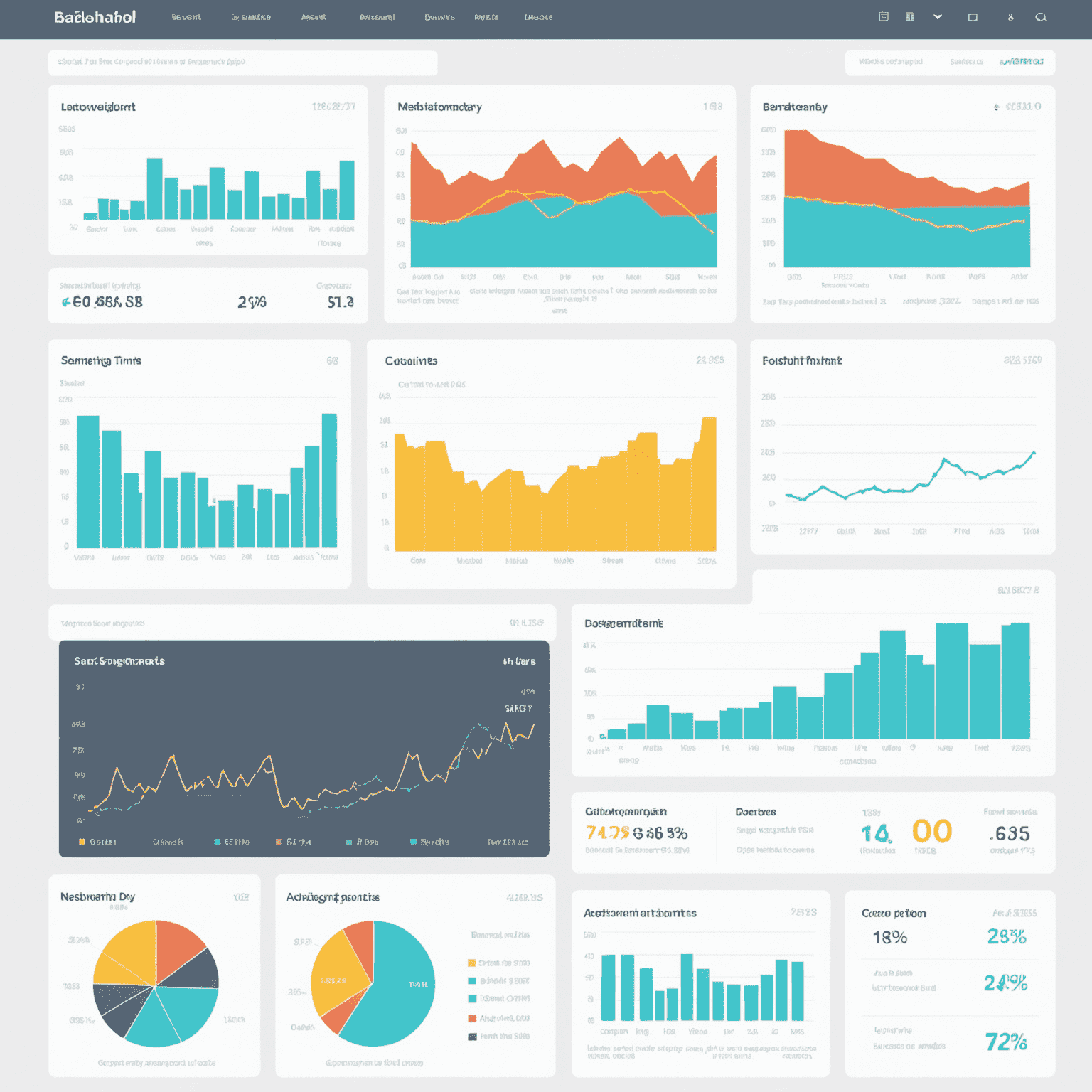

Case Studies: AI in Action

Let's explore some real-world examples of how AI is being used in economic analytics:

Case Study 1: Predictive Analytics for Stock Selection

A leading hedge fund implemented a machine learning algorithm to analyze over 10 years of historical data for S&P 500 companies. The algorithm considered various factors such as economic statements, economic indicators, and market sentiment. As a result, the fund's stock selection process improved significantly, leading to a 15% increase in annual returns compared to their previous strategy.

Case Study 2: AI-Powered Risk Management

A major investment Institution developed an AI system to assess and manage portfolio risk. The system analyzed market data, news events, and economic indicators in real-time to identify potential risks and suggest hedging strategies. This approach led to a 30% reduction in the institution's overall risk exposure while maintaining similar levels of return.

Practical Applications for Individual Investors

While many AI-powered tools are used by large economic institutions, there are also applications available for individual investors. Here are some ways you can leverage AI in your own investment strategy:

- Use AI-powered investment analysis tools to research stocks and other securities

- Implement robo-advisors for automated portfolio management

- Utilize sentiment analysis tools to gauge market sentiment

- Explore AI-driven investment strategy simulators to test and refine your approach

As you explore these tools, remember that while AI can provide valuable insights, it's essential to combine these insights with your own research and judgment when making investment decisions.

The Future of AI in Economic Analytics

As AI technology continues to advance, we can expect to see even more sophisticated applications in economic analytics. Some areas to watch include:

- Natural language processing for more accurate sentiment analysis

- Quantum computing for complex Economic modeling

- Explainable AI for more transparent decision-making processes

- Integration of blockchain technology for enhanced security and transparency

By staying informed about these developments, investors can position themselves to take advantage of the latest advancements in AI-powered economic analytics.

Learn More About Investment Analysis Tools

Interested in exploring AI-powered investment analysis tools for beginners? Our company develops investment strategy simulators and trading decision support tools for various platforms, including Merrill Edge. These tools can help you simulate long-term portfolio growth and compare different trading strategies.

As we've seen, AI is transforming the landscape of economic analytics, offering powerful tools for market prediction, sentiment analysis, and automated trading. By embracing these technologies and combining them with sound investment principles, investors can gain a significant edge in today's complex economic markets.